This time, they’re planning to raise interest rates into what currently consists of decelerating economic growth and worsening credit spreads. In recent cycles when the Fed tightened monetary policy, they did so in an environment of improving credit spreads. Here’s a similar view that shows stocks in year-over-year percentage change terms, to visualize it differently: Credit spreads are in blue and US stocks are in red: Usually when this happens, stocks also run into some turbulence. This is a sign of slowing economic growth and deteriorating assessment of credit quality for junk-rated companies compared to nominally risk-free assets. It’s still at a low level but now has an upward trend.

The interest rate spread between high yield bonds and Treasuries broke out of a year-long basing formation recently. The Omicron wave continues to trend down, and more countries remove various restrictions that they have in place for it:Īt this point the political consensus seems to have shifted to viewing this as an endemic disease rather than a pandemic and I’m optimistic that it will continue to be perceived that way, but that view may be tested to some extent if/when there is another wave in the future.

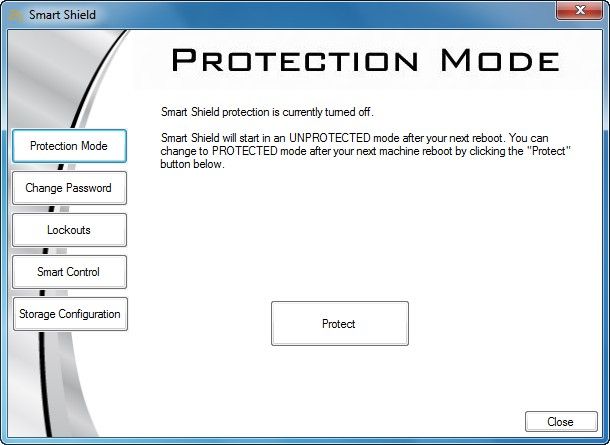

#DEEP FREEZE SOFTWARE SIMILAR UPDATE#

It then provides a market update on bitcoin and smart contract platforms, and then dives into an update on Cigna, a healthcare stock that I’ve been following for some time. The macro section of this report provides an update on the virus, credit markets, inflation, gold, and emerging markets.

0 kommentar(er)

0 kommentar(er)